How to Read Pay Stub for Vacation

How to read your pay stub

"How to read your pay stub" is easy-read guide to help you learn everything you need to know about the information presented in your pay stub each pay flow. That includes:

..... and much much more than. Furthermore, even if you take the basics of reading your pay stub down, this ultimate guide tin exist your key to making certain all the right deductions are made from your bank check.

Getting your first paycheck can exist exciting, but getting your first pay stub can be anything but.

Unless yous have a background in Homo Resources or payroll, figuring how to read your pay stub isn't always easy.

In fact, it can exist downright intimidating if you don't know where to look and what you're looking for.

If you're struggling to understand just what exactly each figure on your pay stub is trying to tell you lot, check out our comprehensive guide on how to read your pay stub.

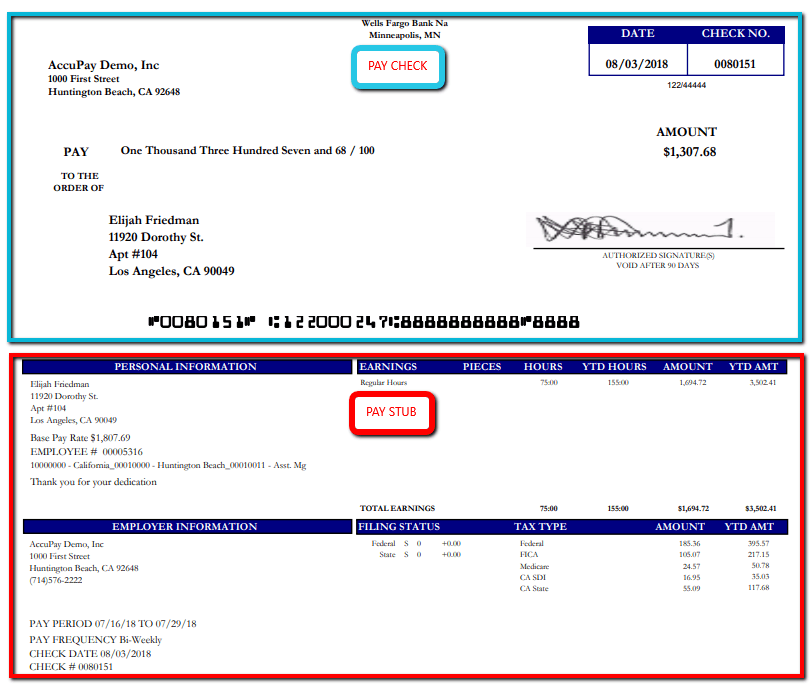

Paycheck vs. pay stub— Is there a departure?

You might fifty-fifty be sitting in that location wondering, "is there a difference of a paycheck vs. a pay stub?"

The respond is yes.

A paycheck is an actual check that y'all can present to your banking concern and have deposited in your account.

A pay stub, on the other hand, is a document— which sometimes comes attached to the check— that summarizes the amounts of the check and gives other necessary data such as deductions.

As straight deposit continues to become the more than pop way of pay, you're less likely to get a paper copy of your pay stub since you won't receive a physical check.

More than frequently, you'll receive an email with a link that volition provide the same details y'all'd run into on a physical copy of a pay stub.

How to read your pay stub: gross pay vs. net pay

One of the real secrets to how to read your pay stub is knowing what distinguishes your gross pay from your net pay.

Without understanding the deviation, you'll struggle to get the full motion picture of what your pay stub is telling you.

In short, gross pay is the amount of money you're paid BEFORE taxes. Internet pay (besides called "take-abode pay") is what remains later on all deductions have been taken out.

How is this information critical to understanding how to read your pay stub?

Here'south how:

Both your gross pay and net pay are listed on your pay stub. Gross pay is as well a line detail that will be listed on your W2, so it's important to keep tabs on this number.

For more data nigh completing your W2 & box 12 codes, check out this free guide.

On your pay stub, your gross salary volition exist cleaved down into wages you lot've earned for the pay catamenia.

This tin can vary based on how many hours you lot've worked, including any over time, and whether or non there'south been a change in your pay, but on about pay stubs this amount should stay relatively stable.

The breakdown:

Your gross pay is calculated using your regular hourly rate, plus whatsoever overtime (typically paid at a time and a half).

While pay stub organization can vary based on the employer, you'll usually find a breakdown of your gross pay looks something similar this:

The number of regular hours worked x your hourly charge per unit = gross pay.

Y'all want to keep an heart on your gross pay to make certain that your net pay is calculated accurately.

From your gross pay, deductions are made. What'southward left over is your net pay.

Deductions can include everything from taxes to health care and retirement costs (more than on that subsequently).

Here's a simple way to know how to read your pay stub when it comes to net pay:

Number of hours regularly worked 10 hourly rate — amount withheld for ALL deductions= net pay

But how do you determine what deductions are being fabricated from your check? And for what purpose?

Keep reading to discover out.

Determining the tax withheld from your check

If you work full time so taxes are withheld from your paycheck each pay flow.

While that may not be a idea that makes yous giddy with glee, knowing what taxes are beingness cut from your check, and why, tin aid you better assess your exemptions.

There are several taxes that can show up on your pay stub. Some are the sole responsibility of the employee. Others are paid by the employer.

They are:

| Employee Taxes | Employer Taxes |

|---|---|

| Federal Income Tax (FIT) | |

| State Income Tax (Sit down) | Federal Unemployment Tax (FUTA) |

| State Disability Insurance (SDI) | State Unemployment Tax (SUTA) |

| Social Security | Social Security |

| Medicare | Medicare |

Taxes practical to employees

Federal Income Tax (FIT):Federal Income Taxes are taxes that are taken out of your earnings by the IRS. You typically elect your exemptions when y'all complete a W-4, and then based off your tax bracket, a specified percentage is deducted from your cheque.

In the U.S. there are vii income taxation brackets you lot tin fall into:

10 pct, 15 per centum, 25 percent, 28 percent, 33 pct, 35 pct, and 39.6 percent.

Land Income Tax (Sit down):Similar to FIT, state income taxes are taken out of your bank check at a country level.

State Disability Insurance (SDI):This detail tax, which gives people covered nether it the benefit of wage replacement in the class of disability insurance and paid family unit leave, is only applicable in certain states such as California.

Taxes paid past employers

Federal Unemployment Tax (FUTA):This is a revenue enhancement paid by the employer. Basically put, FUTA (along with state unemployment programs) funds unemployment payments and provides compensation to those workers who've been laid-off. While the FUTA taxation rate is half-dozen percentage, most employers qualify for a tax interruption of five.4 percent.

State Unemployment Taxation (SUTA):Similar to its federal analogue, SUTA is likewise paid past the employer. Information technology offers a type of unemployment insurance to workers who have lost their jobs.

Shared taxes, W2s and box 12 codes

Social Security: Social security is a federally mandated program, which helps finance retirement. Equally an employee, you volition contribute 6.2 percentage to this fund. Likewise, employers will besides contribute half-dozen.two percent.

Medicare: Medicare provides assist with medical payments for those who have hit retirement. Equally an employee, 1.45 percent of your wages go toward this tax. Employers also pay 1.45 percent.

Call up, if y'all make additional wages during the year (such as tips), uncollected social security and Medicare taxes should exist listed on your among W2 and box 12 codes.

Above all, proceed in listen that different states may also have their own local taxes (or revenue enhancement breaks) applied to income.

While yous may not always encounter the FUTA and SUTA revenue enhancement reflected on your pay stub, you will definitely see Sit down, FIT social security and medicare listed. Usually, you lot'll find these together under the "deductions" section of your pay stub.

Understanding benefit deductions

At present that y'all have an idea of the revenue enhancement deductions listed on your pay stub, it's time to take a await at the other deductions you're likely to see.

While each employee will run across the aforementioned taxes applied to their paycheck, other deductions tin can vary amidst employees.

These discrepancies occur in light of the programs that employees participate in.

Check out the list below for an idea of what benefits are pulled from your paycheck.

Benefits and deductions on your pay stub

Need more information well-nigh taxes and retirement? Check out these revenue enhancement-effective retirement strategies.

Employers may friction match the contributions made to your FSA business relationship or retirement plan. Because all employers are different, some of these amounts may show upward on your pay stub while others don't. For instance, while you may see employer FSA contributions listed on your pay stub, you may not meet those fabricated to your retirement accounts.

Other deductions y'all may see

Of course, at that place are too other deductions you lot made need to know in order to know how to read your pay stub.

While this is in no style a comprehensive listing (if you lot'd like to know more refer hither), these are some of the more common deductions you might see:

How fourth dimension off adds to your pay stub

Time off is another factor that can touch on how to read your pay stub.

Typically, personal time off (PTO) can exist found listed in the same subsection every bit the hours you lot've worked, holiday and overtime.

Essentially, this particular section will evidence y'all what PTO hours yous have available and how many hours you lot've used thus far in the yr.

The representation of those hours may expect something like this:

Hours available/ hours used year-to-date

When it comes to how to read your pay stub in terms of vacation days or fourth dimension-off, this is a good number to proceed your middle on. Since some employers follow the "apply it or lose it" principle, this part of your pay stub tin be critical in helping determine if you demand to take time off.

Virtually of all, you can rely on this section of your pay stub to help yous summate your pay if you plan on taking an extended vacation from work.

Get to know the abbreviations

Office of the central to knowing how to read your pay stub is understanding what the abbreviations used stand up for.

For that reason, nosotros've provided a listing of the most common abbreviations featured on pay stubs and their meaning.

Year-to-date summaries and tax exemptions

Although year-to-appointment summaries can seem useless, they can actually make a few of payroll tasks more hassle-free.

How?

Firstly, they can permit you to ballpark the amount of taxes you're paying and decide if you're paying plenty. It's possible that you're claiming too many (or too few) tax exemptions.

Additionally, twelvemonth-to-engagement summaries can help to brand filling out W2 and box 12 codes then much easier because it volition help you better conceptualize how much an employee made within the year as well as the amounts allocated to other benefits (retirement, insurance, etc.)

By now, you lot've hopefully got a meliorate idea of how to read your pay stub. This information can also provide you lot a meliorate await into how tax withholdings and exemptions work.

Source: https://accupaysystems.com/blog/human-resources/how-to-read-your-pay-stub/

0 Response to "How to Read Pay Stub for Vacation"

Post a Comment